New Trends

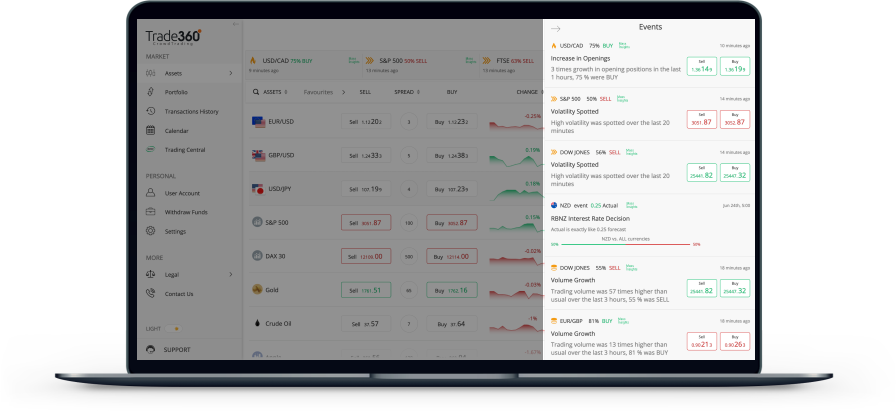

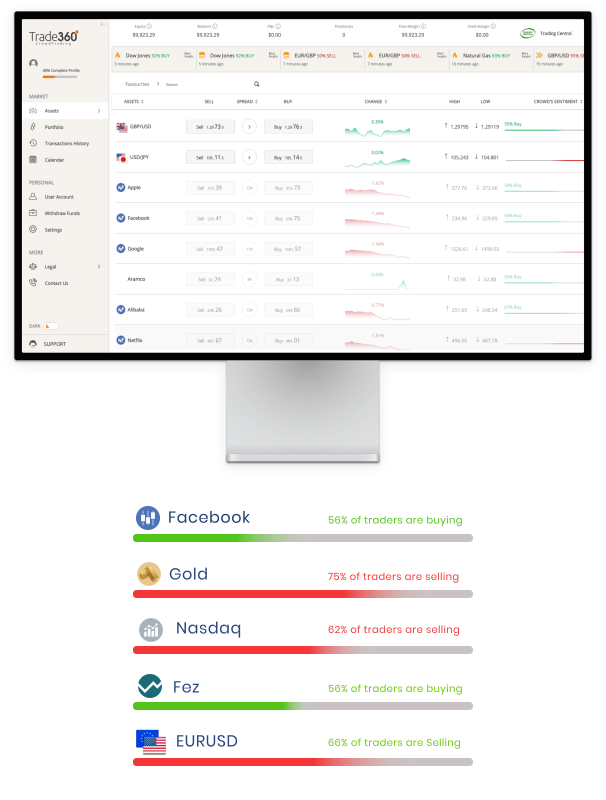

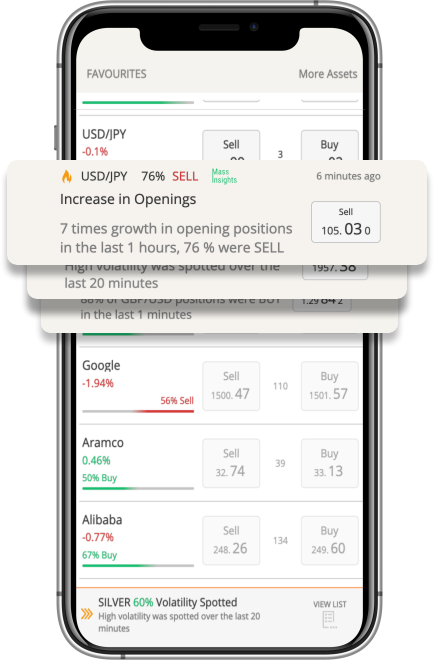

Based on a market event, traders begin opening new buy/sell positions, generating a new trend. CrowdFeed’s Trend Spotting feature will immediately identify the new trend and alert the user.

Rapid Activity

CrowdFeed constantly measures the volume of buys and sells on an asset over a specified time period. It notifies the user of a change in volume and/or volatility.

Surge In Position

A sudden surge in buys or sells usually indicates an expectation on the part of traders ahead of an announcement. CrowdTraders can stay on top of the crowd with this valuable information.

Trend Reversal

CrowdFeed constantly measures the volume of buys and sells on an asset over a specified time period. It notifies the user of a change in volume and/or volatility.